- Short Squeez

- Posts

- 🍋 Nordstrom Family's Power Play

🍋 Nordstrom Family's Power Play

Plus: VC firms are seeing higher partner turnover, Nissan and Honda's $58B merger, Container Store filed for bankruptcy, and Squid Game 2 drops on Dec 26.

Together With

"The ability to do nothing is one of the most underappreciated skills in investing." — Morgan Housel

Good Morning and Happy Christmas Eve! Nissan and Honda announced a $58 billion merger plan to create the world’s no. 3 automaker. The Container Store filed for bankruptcy, echoing recent moves by fellow retailers Big Lots and Party City amid rising competition Walmart and Amazon. VC firms are seeing higher partner turnover, and Netflix is set to release Squid Game season 2 on December 26.

Consumer confidence is slipping as the post-election boost fades, and analysts are warning Wall Street to brace for a potential AI slowdown in 2025.

Plus, Silicon Valley’s White House influence is growing, Luigi Mangione plead not guilty to the murder of Brian Thompson, and when you should be having work meetings hybrid or in-person.

End the year by rewarding your future self. Maximize your coverage and savings—schedule a year-end life insurance review with Optifino today.

We’ll be taking tomorrow off and resuming regular scheduled programming on December 26th. Have a wonderful Christmas!

SQUEEZ OF THE DAY

Nordstrom’s Family Power Play

Nordstrom, the 123-year-old luxury retailer, is going private in a $6.25 billion deal led by its founding family and Mexican retail conglomerate El Puerto de Liverpool.

The Nordstrom family will retain majority control with a 50.1% stake, while Liverpool will hold the remaining 49.9%. The transaction, including $1.2 billion in bank financing, is expected to close in the first half of 2025.

Nordstrom is known for its iconic NYC flagship store on 57th and Broadway, as well as its high-end products. But the company had been struggling with growing online competition and changing consumer habits away from luxury goods.

Once valued at nearly $15 billion, Nordstrom’s market value had fallen to just over $4 billion in recent years. Shareholders will receive $24.25 per share—a 42% premium compared to March, when buyout rumors began.

This is not the first time Nordstrom has attempted to go private. A similar effort in 2018 with private equity firm Leonard Green & Partners had failed. But the challenges facing department stores have only grown since then.

By stepping away from the public markets, the company aims to refocus on long-term strategies to counter e-commerce giants like Amazon and adapt to changing consumer preferences.

Takeaway: With over a century of retail experience, Nordstrom has the legacy and brand recognition to navigate this transition. But the broader challenges facing department stores remain significant, as more consumers shop online and prioritize price over brand loyalty. Going private may give Nordstrom the breathing room it needs to reinvent itself in a highly competitive retail landscape without Wall Street breathing down its neck.

PRESENTED BY OPTIFINO

Are You Overpaying for Your Life Insurance?

Life insurance premiums can vary by as much as 60% for the same product across carriers. With nearly half of agents tied to specific providers, many policyholders end up overpaying for policies that don’t match their goals.

Optifino’s professional review can help. Our platform improves policy benefits 70% of the time, often securing up to:

A 230% increase in coverage, or

40% savings on premiums

Life insurance isn’t just about protection—it’s a tool to:

Secure tax-free retirement income

Reduce or eliminate estate taxes

Cover long-term care

Get an expert review today to ensure your policy is working as hard as you are.*

HEADLINES

Top Reads

Honda and Nissan unveil plan for $58bn merger by 2026 (FT)

Automakers agree to consider merger, would create 3rd largest auto group (Fox)

The Container Store files for bankruptcy, insists it's here to stay (Fox)

Netflix hopes to recapture ‘Squid Game’ magic (NYT)

Venture Capital partners are leaving big firms in droves (BB)

Consumer confidence drops as election boost fades (Axios)

Wall Street needs to prepare for an AI slowdown in 2025 (BB)

Luigi Mangione pleads not guilty to murder of health insurance CEO (CNBC)

Muni market's record year for mega deals gives bankers a win (YF)

Xerox to buy Lexmark for $1.5B (WSJ)

Steve Ballmer, the non-investing guru of investing (WSJ)

Fed announces changes to bank stress tests in light of legal rulings (YF)

Rocket Homes accused of illegal kickback scheme (CNN)

Silicon Valley’s White House influence grows (CNBC)

IBM's new enterprise AI models are more powerful than OpenAI or Google (ZDNet)

CAPITAL PULSE

Markets Rundown

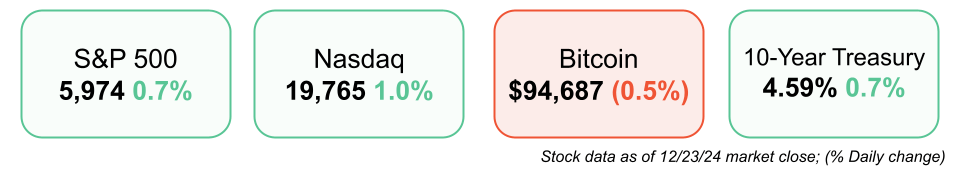

Stocks Start Holiday Week Higher

Equity markets rallied on Monday, reversing earlier losses as communication and technology stocks led the charge.

Global markets followed suit, with Asian stocks boosted by last week’s lower-than-expected U.S. PCE inflation readings and optimism surrounding the proposed Honda-Nissan merger, which could stabilize Nissan amid declining sales.

The U.S. dollar strengthened against major currencies, while WTI oil dipped on expectations of a supply surplus and continued dollar strength.

Government Shutdown Averted

Congress passed a continuing budget resolution late Friday, which President Biden signed into law on Saturday, ending fears of a government shutdown.

The bipartisan bill funds the government at current levels for three months while providing additional disaster relief and farm aid. However, efforts to include a Treasury debt ceiling increase, requested by President-elect Trump, failed due to insufficient support.

This resolution is a positive signal for markets, as it removes risks of disruptions to government services and delayed paychecks.

Bond Yields Hit Multi-Month Highs

The 10-year Treasury yield climbed to 4.59%, its highest level since May, continuing its upward trend since September’s lows.

The yield has increased by 95 basis points over the past few months, reflecting reduced expectations for additional Fed rate cuts amid slowing disinflation and a resilient labor market.

Markets now anticipate only one more rate cut in the next year as the Federal Reserve adopts a cautious approach to easing.

Movers & Shakers

(+) Honda ($HMC) +13% after the automaker announced plans to merge with Nissan.

(+) Xerox ($XRX) +13% after the company bought Lexmark for $1.5 billion.

(–) MicroStrategy ($MSTR) -9% after selling stock to buy more Bitcoin.

Private Dealmaking

Nordstrom to go private in $6.25 billion deal with founding family

Xerox to buy Lexmark for $1.5 billion

SpinSci, a patient engagement tools provider, raised $53 million

Nuitee, a hotel booking startup, raised $48 million

Decart, a GenAI research lab, raised $32 million

Blackflip, a generative AI startup, raised $30 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

BOOK OF THE DAY

The Power and the Money

In The Power and the Money, acclaimed presidential historian Tevi Troy takes readers on a riveting journey through the biggest battles between CEOs and the nation’s commander in chief. He unearths the untold stories – both political and personal – that have shaped America.

Troy shows how the vast reach of the federal government become a critical fact of life for every business, entrepreneur, and innovator. Today, companies find themselves navigating a competitive landscape defined by stringent regulations, so top CEOs and key business leaders must influence the legislative and regulatory system.

As public affairs teams and government relations experts put forward strategies to survive Washington, CEOs have become the most important warrior on the frontlines. The Power and the Money shows how some of the nation’s most important CEOs forged (and fumbled) relationships with the president.

Troy also shows how the most powerful man in the world depends on CEOs. CEOs provide assistance in the form of personnel, policy insights, and campaign cash, but they also become essential foils for presidents, serving as both allies and convenient enemies.

The Power and the Money reveals an intricate web of power, where CEOs need presidents, and presidents need CEOs. Troy shows how each must step carefully – or risk unpredictable costs and collateral damage.

From heavyweights John D. Rockefeller and Mark Zuckerberg to Katherine Graham, Elon Musk, and more, Troy takes readers inside the friendships and the conflicts that shook the American economy and re-shaped America.

Drawing on his experiences as bestselling historian and former senior White House aide, Troy offers unique insights and details that shed light on the growing, intertwining behemoths of government and big business – and what it means for the future of our nation.

“When U.S. presidents clash with corporate titans, what tips the balance of power?”

DAILY VISUAL

When People Finish Holiday Shopping

PRESENTED BY THE AVERAGE JOE

Guide to Becoming the Master of Coin

Step 1. Travel back to the period 298 A.C.

Step 2. Don't forget to take The Average Joe with you.

Their free financial newsletters will help you become a better investor and master of coin…

You’ll be knowledgeable enough to run the king’s royal treasury.

Clever enough to build a commodity empire selling bushels of wheat (or trade it all away for some brick).

Stay up to date with the economic state of each of the Seven Kingdoms.

Back to the present: The Joe’s free financial newsletters are short, simple and concise — jam packed with market trends, news, and insights that are relevant and impactful.

DAILY ACUMEN

Caffeine

Caffeine is a go-to energy booster, but its effects on sleep can be more far-reaching than we realize.

A recent study shows that while a single cup (100 mg) has minimal impact even four hours before bed, a higher dose (400 mg, or four cups) can disrupt sleep up to 12 hours before bedtime.

These disruptions—less deep sleep, more awakenings, and shorter rest—often go unnoticed, as subjective sleep quality doesn’t always match the objective damage.

This hidden impact reminds us to be mindful of caffeine’s timing and dosage.

Small changes, like cutting back in the afternoon, can improve both sleep and energy the next day. Your evening brew might be costing you the rest you need.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

Ain’t no PE firm better than Dad Capital Partners

— Overheard on Wall Street (@OHWallStreet)

4:04 PM • Dec 23, 2024

How your email finds me this week

— Freak in the Sheets (@FreakinDSheet)

1:20 PM • Dec 22, 2024

What'd you think of today's edition? |

*Life insurance technology and life insurance are provided by Optifino, Inc. (DBA Optifino Insurance Services in New York) (“Optifino”). Optifino is a licensed insurance producer in all states where it offers products, and acts as an agent for various insurance companies. License information available here. The information on this website has been developed by Optifino, Inc and is for informational purposes only. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Products and specific product features may not be available in all states, and other limitations or restrictions may apply. Securities offered through The Leaders Group, Inc. Member FINRA/SIPC 26 W Dry Creek Circle, Suite 800, Littleton, CO 80120, 303-797-9080. Optifino is not affiliated with The Leaders Group, Inc. Check the background of your financial professional or broker/dealer with FINRA BrokerCheck.

Reply