- Short Squeez

- Posts

- 🍋 Never Bet Against Musk

🍋 Never Bet Against Musk

Plus: Starbucks’ Red Cup Day came in red hot. Elon's mom on her son's relationship with Trump. Blackrock close to buying HPS for $12B, and Mexico warns tariffs will cost 400k US jobs.

Together With

“During the Twitter takeover, Elon Musk sent an email asking, ‘What did you get done this week?’ Now imagine that same question being applied to the government.” — Marc Andreessen

Good Morning! Hope y’all had a great Thanksgiving. If your turkey was easier to cook this year, AI might have been the secret ingredient.

Starbucks’ Red Cup Day came in red hot and was the best U.S. sales day ever. BlackRock is closing in on a $12 billion deal to buy private credit firm HPS. SoftBank-backed Symbotic saw its shares plunge over 30% after accounting slip-ups, while OpenAI got a $1.5 billion stock tender boost from SoftBank. And Mexico warned Trump’s tariffs could cost 400,000 U.S. jobs.

Plus, Warren Buffett’s life advice for building a strong family, and Maye Musk describes the unique relationship between Trump and her ‘genius’ son.

Did you miss it?! Peek our most recent Buysiders edition for an exclusive investment opportunity.

Choose luxury this Black Friday—Explore timeless Italian gifts from Luca Faloni.

SQUEEZ OF THE DAY

Never Bet Against Musk

Whether you’re a Tesla short seller or just a general Musk skeptic, it’s pretty clear - you don’t want to bet against Elon Musk. Somehow, he keeps finding new ways to defy the odds and create value for his investors.

Wall Street investors who bet on Musk’s $44 billion Twitter takeover, only to see it nosedive in value, are now getting a major comeback story. And it’s all thanks to xAI, Musk’s artificial intelligence venture.

When Musk launched xAI last year to rival OpenAI and Anthropic, he threw his Twitter/X backers a lifeline: 25% equity in the new venture.

As of November 2024, xAI’s valuation has doubled to $50 billion in just six months, thanks to a $5 billion fundraising round set to close this week. For Twitter backers like Fidelity, Larry Ellison and Jack Dorsey - many of whom were staring down multi-billion-dollar paper losses - xAI is a godsend.

Take Fidelity, for example. The asset manager, which slashed its X valuation by nearly 80%, could now be made whole thanks to xAI.

But it’s not without risk. Musk’s interconnected empire—between Tesla, SpaceX, X, and now xAI—can create conflicts of interest. Investors now mostly hold stakes across multiple Musk-led ventures, but they’re basically on both sides. However, the overlaps can have a silver lining - especially when one company’s struggles (Twitter/X) are another’s lifeline (xAI).

Takeaway: Investors in xAI aren’t just investing in the technology - they’re investing in Musk, and want to stay in his orbit. Looks like that thinking has already bore fruit with Musk becoming best pals with president-elect Donald Trump and tasked to lead the Department of Government Efficiency. It just goes to show betting against the world’s richest man is a gamble few can afford to take.

PRESENTED BY LUCA FALONI

Gift the Elegance of Italian Craftsmanship This Christmas

This holiday season, elevate your gifting with Luca Faloni’s collection of timeless menswear and accessories. From the softest cashmere sweaters to impeccably tailored cotton shirts and classic leather pieces, every item is meticulously crafted in Northern Italy to embody true Italian luxury.

Whether for a loved one or yourself, a gift from Luca Faloni is more than a present—it’s a celebration of craftsmanship and refinement.

HEADLINES

Top Reads

Starbucks says red cup day sets U.S. sales record (WSJ)

Thank AI for killing off the worst part of Thanksgiving meal prep (WSJ)

BlackRock nears $12 billion deal to buy HPS (YF)

Fed’s preferred inflation gauge rises to 2.3% annually, meeting expectations (CNBC)

Morgan Stanley fails client vetting (WSJ)

Shares of SoftBank-backed Symbotic plunge after accounting errors (YF)

OpenAI's $1.5B boost from Softbank (CNBC)

T-Mobile, SpaceX in satellite pact (YF)

Hong Kong is becoming a hub for financial crime, US lawmakers say (CNN)

Mexico warns Trump tariffs would kill 400,000 US jobs (YF)

AllHere founder arrest shows it's easy for startups to scam VCs (Axios)

Warren Buffett’s life advice for building a strong family and lasting legacy (BB)

Donald Trump selects Kevin Hassett to lead National Economic Council (CNBC)

Mortgage rates edge lower after Trump's Bessent pick (YF)

Elon Musk’s mother describes unique relationship between Trump and Elon (Fox)

CAPITAL PULSE

Markets Rundown

Inflation Data Offers Stability, but Progress Lags

Thanksgiving Eve saw Wall Street take a step back, breaking its recent winning streak as mega-cap tech stocks faced renewed pressure. Inflation data provided no major surprises, coming in line with expectations and signaling a steadying economy. The Federal Reserve's preferred metric, the PCE Price Index, increased by 0.2% month-over-month, while core prices (excluding food and energy) rose 0.3%.

The annual core rate held firm at 2.8%, hinting that inflation remains sticky but manageable. Treasury yields dipped to a one-month low, with the 10-year yield falling to 4.24%. This drop boosted the probability of a December Fed rate cut to 66%, sparking optimism for lower borrowing costs.

Sector Shifts Reveal Resilience

While the S&P 500 dipped just below the symbolic 6,000 mark, the broader market displayed quiet resilience, with more stocks gaining than losing. Real estate, health care, and financials emerged as top performers, benefiting from falling yields.

Meanwhile, tech remained in the doldrums, weighed down by Nvidia's continued struggles and Dell Technologies' sharp 12% drop after disappointing earnings and guidance. Workday, despite beating expectations, lost over 6% on conservative forecasts. Nordstrom's better-than-expected earnings were overshadowed by cautious holiday guidance.

Energy stocks also slipped as crude oil prices declined on ceasefire news from Lebanon, but small caps showed renewed strength, signaling investor confidence in broader economic growth.

Mixed Economic Signals Keep Markets Guessing

Economic data delivered a mixed bag. Durable goods orders declined 0.2% in October, underscoring persistent manufacturing challenges. Initial jobless claims fell to 213,000, reflecting a stable labor market, though continuing claims hovered near three-year highs, suggesting it's harder to find new jobs after losing one.

Third-quarter GDP growth remained steady at 2.8%, but a slight downward revision to consumer spending raised questions about the economy's key driver. Despite these data points, the broader economic narrative remains one of resilience, with consumers and businesses showing signs of adaptability in a shifting landscape.

Looking Ahead to Global Data and Holiday Optimism

As investors gear up for Thanksgiving, attention turns to international markets, where Friday's inflation and manufacturing updates from Japan and China could set the tone for global sentiment. Domestically, the markets will resume Friday with a short session and an eye on Black Friday consumer spending trends.

With inflation moderating and rate cuts still on the table, the year-end rally narrative remains intact. Investors can be thankful for a stable economy, falling yields, and the potential for a robust December finish.

Movers & Shakers

(+) Urban Outfitters, Inc. ($URBN) +18% after the clothing retailer beat earnings; Baird raised its price target.

(+) Solaredge Technologies ($SEDG) +9% because of job cuts; the company will close its energy storage division.

(–) Symbotic Inc. ($SYM) -36% after a filing delay due to accounting errors; lowered outlook.

Private Dealmaking

Eyewa, an eyewear seller, raised $100 million

Eon, a cloud backup platform, raised $70 million

Dev Agents, an AI agents operating system, raised $50 million

TailorMed, a financial aid for medical costs platform, raised $40 million

Clean Skin Club, a disposable facial towers developer, raised $32 million

Wordware, an AI development operating system, raised $30 million

For more PE, VC & M&A deals, subscribe to our Buysiders newsletter.

NEIGHBORHOOD WATCH

Real Estate Digest

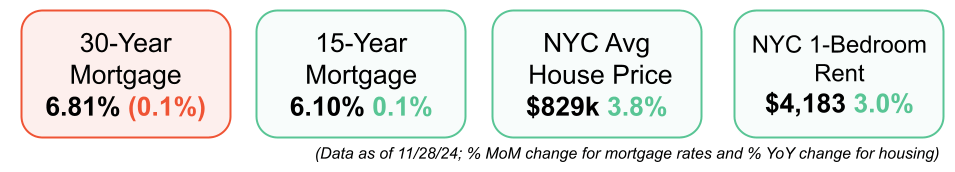

Rates ticked back up slightly this week. Heading into the holidays purchase demand is expected to slow down but there has been an increase in activity in the two weeks following the election. While for-sale inventory is increasing modestly, the elevated rate environment has caused new construction to soften.

Meanwhile, growing confidence in the U.S. economic outlook is fueling discussions around heightened deal-making. This momentum could have ripple effects on real estate markets, particularly in key finance and tech hubs.

Latest News

New Listings

510 Park Avenue Apt: 6A New York, NY: 5 Bed / 5.5 Bath - $5,995,000

501 38th St West Palm Beach, FL: 3 Bed / 3 Bath- $2,295,000

50 Eveningside Dr Milford, CT: 4 Bed / 4.5 Bath - $2,900,000

367 S Bundy Dr Los Angeles, CA: 3 Bed / 2 Bath - $3,200,000

21 The Bishops Ave London, United Kingdom: 8 Bed / 7 Bath - $10,988,075

36 Gramercy Park East Apt: 5N New York, NY: 3 Bed / 2.5 Bath - $4,999,000

Fill out this form if you're looking to buy, sell, rent or invest.

BOOK OF THE DAY

Uncommon

To be common is to be an everyday person. It's to do the things that you are expected to do, whether that's what your parents want for you, or your employer, or your spouse, et cetera.

But if you want to be more than you are, more than you think you can be, then you need to recognize and learn from your mistakes to lead a life of excellence.

As an elite Navy SEAL, entrepreneur, author, speaker, professor of leadership, and philanthropist, as well as the creator of SEALFIT, Kokoro Yoga, and Unbeatable Mind, Mark Divine uses years of wisdom, business development, martial arts, eastern philosophy and military experience to take you through life's most important principles for finding your pursuit of excellence--so that you or anyone with the proper motivation can become uncommon.

“From former Navy SEAL, entrepreneur, father, and New York Times bestselling author Mark Divine comes Uncommon– an inspirational book following Mark Divine's trademark warrior monk philosophy that will lead you to the summit of personal development.”

DAILY VISUAL

Retail Gas Prices Are Falling

Source: Apollo

PRESENTED BY HEBBIA

Automate Deal Diligence + Save Hours Per Day

Here’s why 30% of the top 50 asset managers use Hebbia, the AI designed specifically for finance/deal diligence.

Saves hours of work per day on diligencing, screening, memo writing

Scans PDFs, documents, and more (no length limit)

Drafts one-pagers off your team’s investment philosophy

Don’t just take our word for it–Andreessen Horowitz, Index Ventures, Google Ventures, and Peter Thiel just invested $130 million into this game-changing AI.

DAILY ACUMEN

Ambition

Many people shy away from ambition, mistaking it for an aggressive desire to win at all costs. But ambition, when channeled well, is about striving for growth, both personally and professionally. It’s the spark that pushes us to achieve our goals and gives our work purpose. A healthy dose of ambition can elevate our careers and even boost our happiness.

The trick lies in reframing ambition: it's not about competition with others, but about achieving your own growth and potential. Research shows that when ambition is paired with cooperation, it not only helps you excel but also strengthens relationships at work, leading to higher chances of getting promoted. Think of ambition as a ladder that can help you rise, but also help others do the same.

Ambition also leads to greater achievement. Ambitious people tend to set bigger goals and invest more energy in pursuing them. This drive creates opportunities—taking on new initiatives at work, stepping up to lead projects, or acquiring skills others shy away from. Ultimately, this persistence results in higher levels of satisfaction, income, and success.

Moreover, ambition doesn’t have to be a lonely pursuit. It’s contagious—when you set ambitious goals and pursue them with enthusiasm, it inspires others around you. In a team environment, this can improve productivity, creating a culture where everyone aims high. And when people around you are motivated, it naturally drives you to work better, fostering a more connected and inspired workplace.

The key is to let your ambition shine without letting it turn into ruthless competitiveness. Use it to drive your growth, support your team, and achieve meaningful results that are fulfilling for you and those around you. Ambition, when balanced with empathy, becomes a powerful tool for personal and professional happiness.

ENLIGHTENMENT

Short Squeez Picks

MEME-A-PALOOZA

Memes of the Day

🚨Breaking🚨 El Salvador President Nayib Bukele has banned Jim Cramer from entering the country

— Alan Carroll (@alancarroII)

3:47 PM • Nov 26, 2024

calling cantor fitzgerald a financial empire is crazy work

— big strong guy, he’s a big strong guy (@HESaBSG)

2:49 AM • Nov 27, 2024

What'd you think of today's edition? |

Reply