- Short Squeez

- Posts

- 🍋 Dimon's $141 Million Move

🍋 Dimon's $141 Million Move

Jamie Dimon will sell $141M of JPMorgan stock in 2024, plus Two Sigma hedge fund rekt by a trading scandal, and buying the dip is back.

Together With

"The best work is not what is most popular. It's what's hard to copy." — Reed Hastings

Good Morning! If your checking account is looking light after Halloweekend...you're not alone. The U.S. savings rate is on the decline, but it's good news for the economy with consumer spending driving growth. Hedge fund Two Sigma got rocked by a trading scandal - a 'researcher' apparently made unauthorized adjustments that resulted in $620 million in unexpected gains and losses.

Buying the dip isn’t going out of style - at least not in the bond market. Investors have splurged $21 billion into TLT, BlackRock's long-dated Treasury fund, so far this year. And Fidelity just marked Twitter/X’s value down by 65% since Elon Musk bought it a year ago.

SQUEEZ OF THE DAY

Dimon’s $141 Million Sell-Off

On Friday, Jamie Dimon announced plans to sell 1 million shares of the bank's stock, worth $141 million. It’s a big deal because it’s Dimon's first stock sale since he took the CEO throne back in 2005.

And he says there’s a legit reason why he’s selling now – it's all about "financial diversification and tax planning," at least according to the official statement. But is that really all there is to it? Or does the move hint at a new career path for Dimon in the political arena?

The sale won't start 'til 2024. But JPMorgan’s stock took a bit of a hit, dropping by 3.6% right after the announcement. Dimon’s sale represents a 12% chunk of what his family holds in the company. As of the last market close, they own around 8.6 million shares, worth $1.2 billion.

Some speculate that Dimon might be gearing up to make a political move. Dimon's not just any CEO – he's got some serious political connections up his sleeve. During the Obama Administration, Warren Buffett gave Dimon the thumbs-up as a possible Treasury Secretary. And as recently as last June, Bill Ackman endorsed Jamie Dimon for President.

Takeaway: CEOs of publicly traded companies have to announce any time they sell stock, and given Dimon's profile and political flirtations, it makes sense why this made the front page of WSJ and the like. But we take Dimon’s word that he’s not selling because he’s necessarily cynical on $JPM’s future. Maybe it's simply a strategic move to take some chips off the table and eye a potential presidential run?

CAPITAL PULSE

Markets Rundown

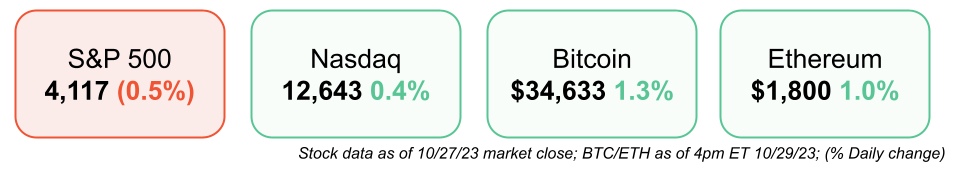

Stocks closed mixed as Wall Street makes sense of earnings.

Movers & Shakers

(+) Intel ($INTC) +9% after earnings beat; progress towards $3B in cost savings.

(+) Chipotle ($CMG) +4% after Americans’ burrito cravings defy high prices.

(–) Enphase Energy ($ENPH) -15% because the solar company warned of a substantial demand drop.

Private Dealmaking

Rithm Capital agreed to buy Sculptor Capital for $720 million

Eavor, a geothermal energy developer, raised $131.2 million

AgentSync, a compliance software provider for insurers, raised $50 million

Debut, a sustainable fragrance developer, raised $40 million

Arteria AI, a documentation infrastructure startup, raised $30 million

3CentML, a machine learning efficiency startup, raised $27 million

SPONSORED BY RANGE

Looking for a Better Way to Manage Your Wealth?

Are you ready to transform your financial future? Range.com is here to revolutionize wealth management, offering an all-in-one platform that seamlessly integrates every facet of your financial life:

📈 Investment Strategy

📊 Tax Optimization

🌟 Retirement Planning

💰 Cash Flow Management

🏡 Estate Planning

Experience a new era in financial empowerment by partnering with a dedicated team of financial experts at Range.

HEADLINES

Top Reads

U.S. investment banks see early signs of revival in dealmaking (Reuters)

The incredible rise of Celsius energy drink (BB)

Don’t blame the consumer for the market entering correction territory (CNBC)

Unilever is selling Dollar Shave Club to private equity (Axios)

5 ways Americans keep proving economists wrong (WSJ)

Why Exxon and Chevron doubling down on fossil fuel makes sense (YF)

Why the shine has come off clean energy stocks (WSJ)

Elon Musk knew he made a bad bet on Twitter - he was right (Axios)

Bad loans are becoming a real problem for regional banks (YF)

Fraud allegations could roil private equity’s typical defenses (Axios)

BOOK OF THE DAY

Economic Facts And Fallacies

Economic Facts and Fallacies exposes some of the most popular fallacies about economic issues-and does so in a lively manner and without requiring any prior knowledge of economics by the reader.

These include many beliefs widely disseminated in the media and by politicians, such as mistaken ideas about urban problems, income differences, male-female economic differences, as well as economics fallacies about academia, about race, and about Third World countries.

One of the themes of Economic Facts and Fallacies is that fallacies are not simply crazy ideas but in fact have a certain plausibility that gives them their staying power-and makes careful examination of their flaws both necessary and important, as well as sometimes humorous.

“Thomas Sowell “both surprises and overturns received wisdom” in this indispensable examination of widespread economic fallacies.”

ENLIGHTENMENT

Short Squeez Picks

Adam Grant’s #1 phrase to unlock potential

How to be more interesting, according to science

Look out for these red flags in a job interview

How to destroy pessimism and cultivate hope

Netherlands named best country to retire - see where others stack up

DAILY VISUAL

Americans are Spending More While Saving Less

US personal saving rate

Source: Axios

WHAT ELSE TO READ

The best PE & VC Newsletter

We launched Buysiders in September 2023 to bring y’all the best insights on deals around Wall Street.

From Insider deal details to insightful charts like the one below:

Total Capital Raise vs. First Time Fund Share

We will also be sending exclusive investment opportunities to all Buysiders.

If you work on the buyside or aspiring to work on the buyside or just want access to private deal flow, this newsletter is for you. Subscribe here.

DAILY ACUMEN

Tiny Delights

"What we consider defining moments, like promotions or a new house, matter less to life satisfaction than the accumulation of tiny moments that didn't seem to matter at the time.

In the end, everyday moments matter more than big prizes.

Tiny delights over big bright lights."

Source: Clear Thinking book

MEME-A-PALOOZA

Memes of the Day

What'd you think of today's email? |

Reply